pay indiana estimated taxes online

TurboTax online and mobile pricing is based on your tax situation and varies by product. Indiana State Teachers Retirement Fund This is the designated Indiana retirement system for all teachers and professors at K-12 schools or institutes of higher learning As public teaching here is a union-based employment scenario this plan is limited to educators excluding non.

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Find Indiana tax forms.

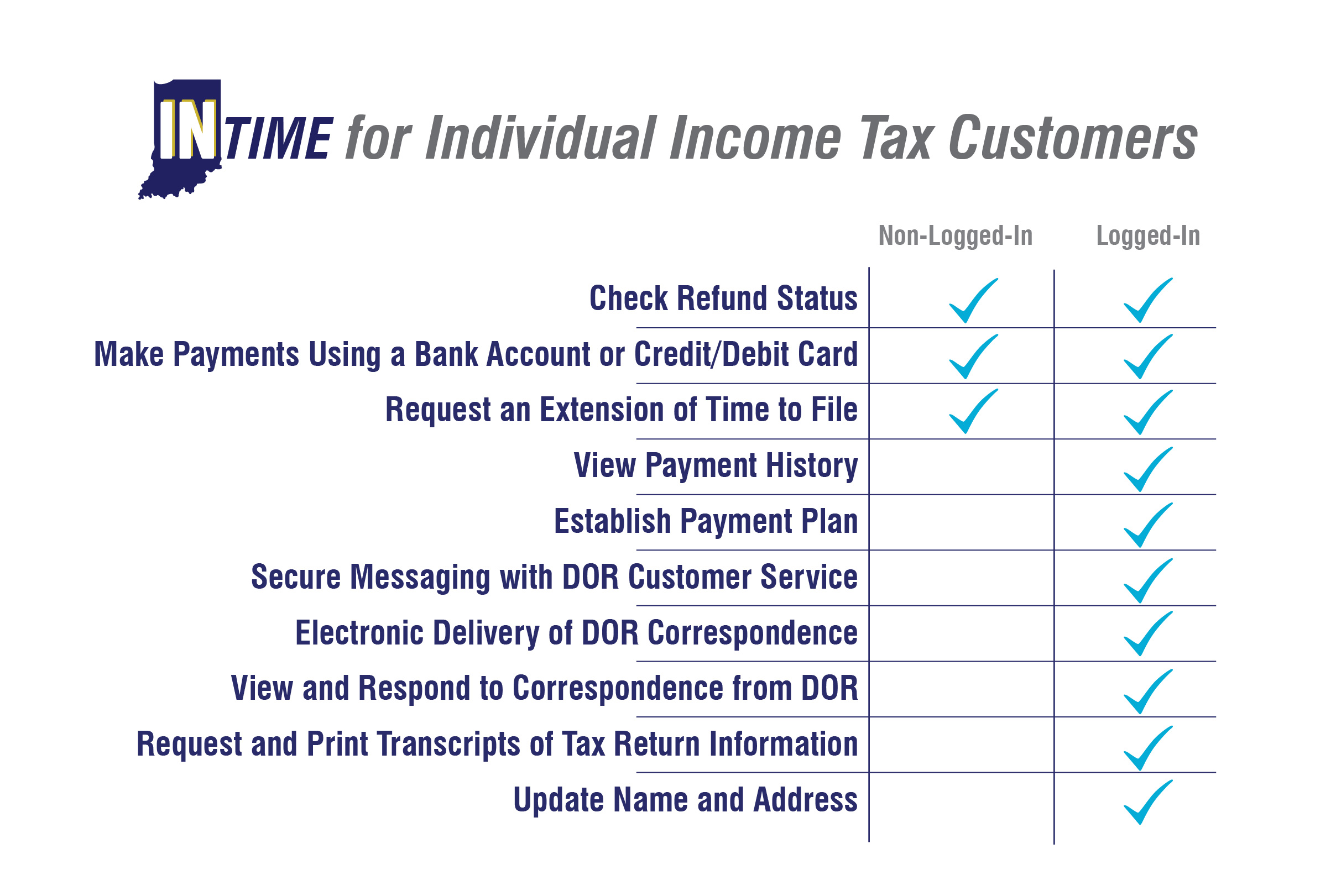

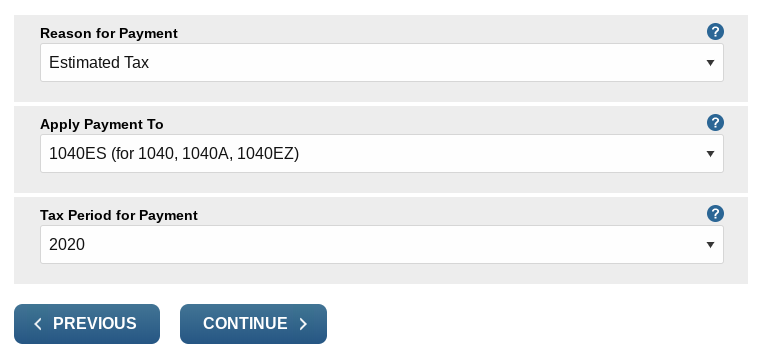

. The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services portal for customers to use when managing individual income tax business sales tax withholding and corporate income taxFor more information on the modernization project visit our Project. We would like to show you a description here but the site wont allow us. Switch to federal hourly calculator.

Have more time to file my taxes and I think I will owe the Department. These local taxes could bring your total Indiana income tax rate to over 600 depending on where you live. POPULAR FORMS.

If you are mailing your Indiana return the complete filing instructions should print with your state return including the address to mail. Discover the latest MLB News and Videos from our Experts on Yahoo Sports. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator.

TurboTax Free Edition 0 Federal 0 State 0 To File is available for simple tax returns only and has limited functionality. Offer may change or end at any time without notice. Get breaking news and the latest headlines on business entertainment politics world news tech sports videos and much more from AOL.

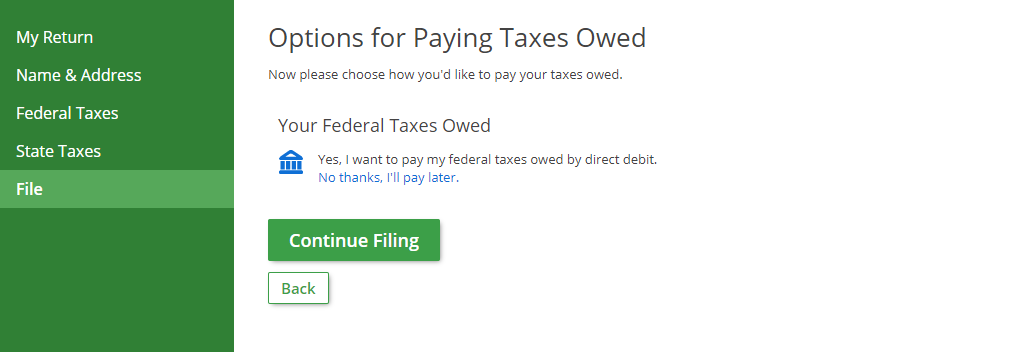

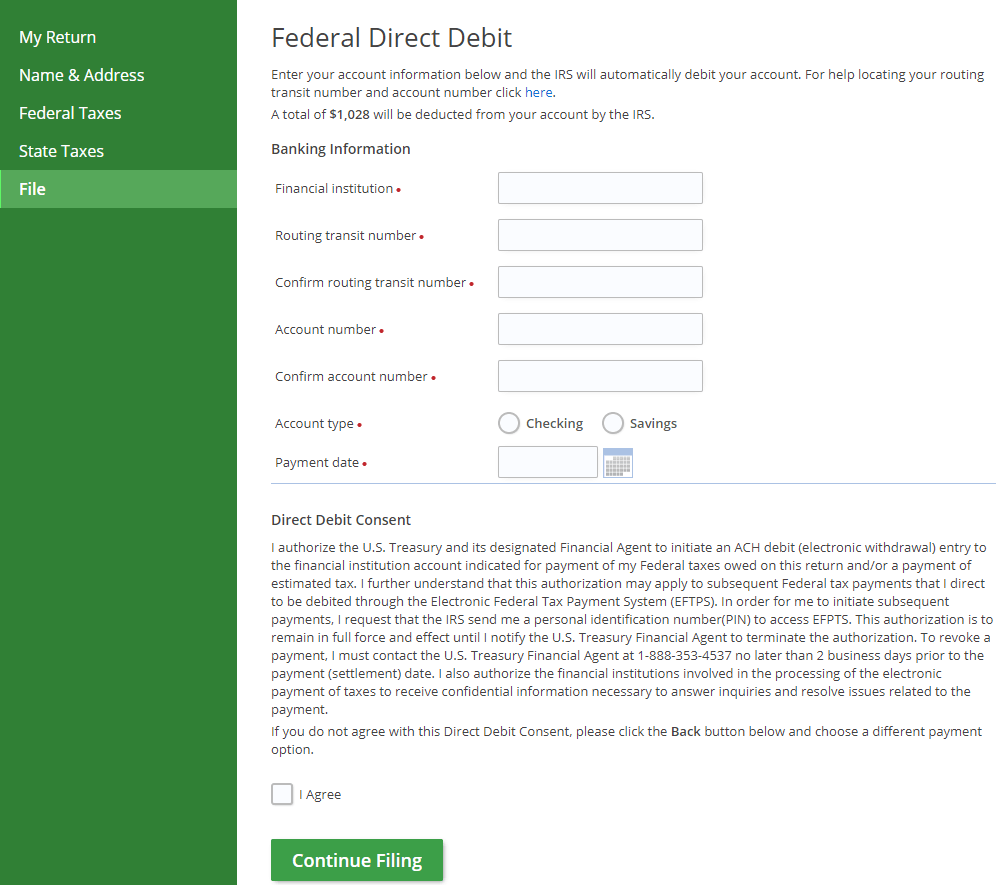

Pay your taxes online using your checking account or creditdebit card. Try for FreePay When You File. Claim a gambling loss on my Indiana return.

You will need your Assessors Identification Number AIN to search and retrieve payment information. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. That penalty starts at 05 of your total tax owed and increases every month you dont pay.

Request for Taxpayer Identification Number TIN and Certification. Individual Tax Return Form 1040 Instructions. Usually thats enough to take care of your income tax obligations.

Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current. All 92 counties in the Hoosier State also charge local taxes. But in general there are two main pages to the IT-40 Indiana full year resident return.

You will sign the second page of the IT-40 and place all other pages of the tax return behind it. Know when I will receive my tax refund. The only way to partially delay paying taxes is to take.

Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status. Heres a quick rundown on paying your estimated taxes. Take the renters deduction.

You can check the status of your Form 1040-X Amended US. If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form. Youll pay taxes on the lottery payments you receive each year if you spread your winnings out over a period of years.

Tax payments over 100000 may come with special requirements and these. You might also be required to pay estimated taxes ahead of time. But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file.

There are a few additional details to note about paying your federal taxes with a credit card according to the IRS. Overview of Indianas Main Retirement Systems. Instructions for Form 1040 Form W-9.

Pacific Time on the delinquency date. Overview of Indiana Taxes. If you wait until the end of the year to file taxes youll have to pay a penalty.

Individual Income Tax Return using the Wheres My Amended Return. Paying the IRS Federal. You can make online payments 24 hours a day 7 days a week up until 1159 pm.

See IRSgov for details. For a more detailed walkthrough check out our guide on how to file quarterly taxes. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return. Pay my tax bill in installments. Both tools are available in English and Spanish and track the status of amended returns for the current year and up to.

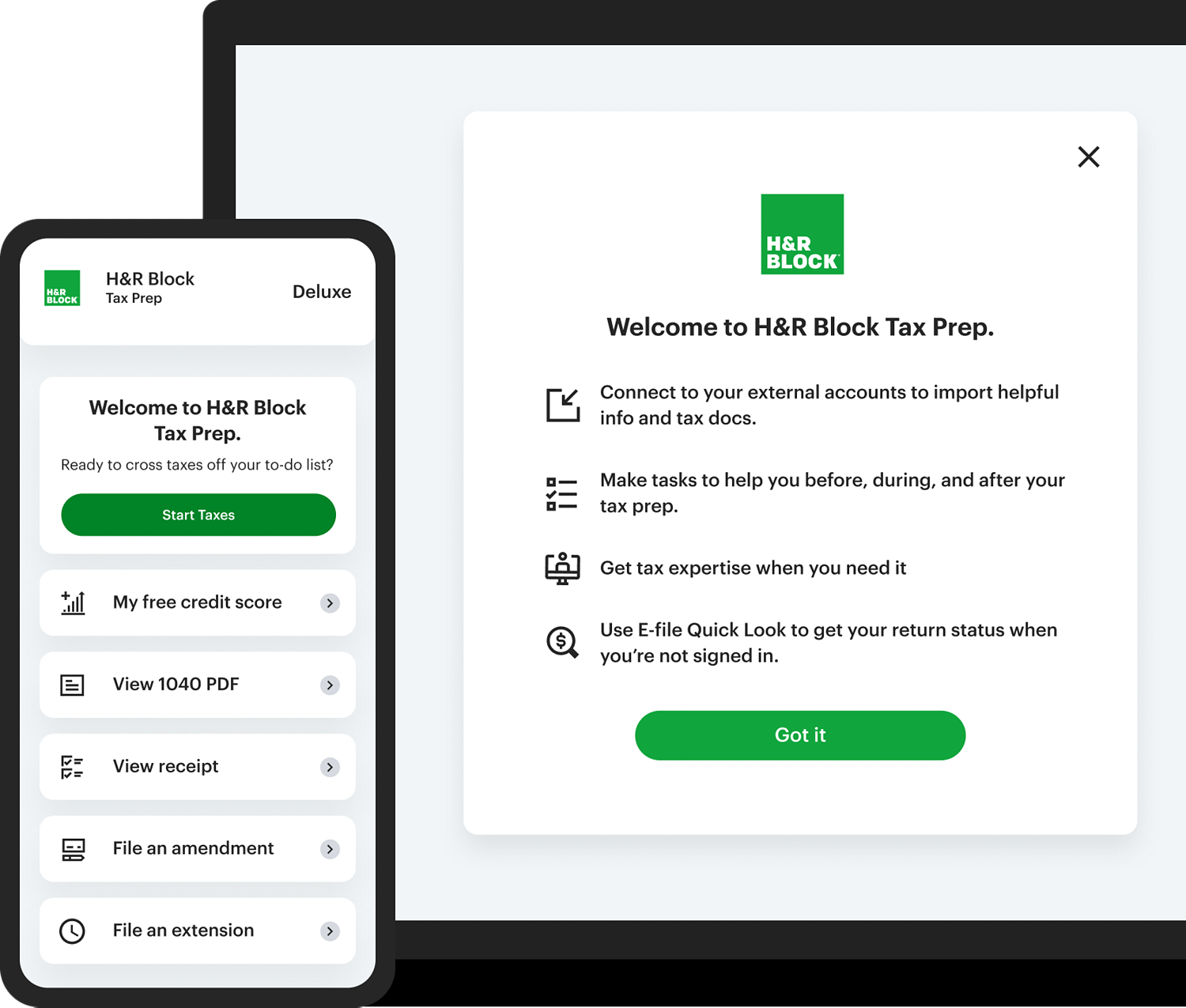

Deluxe Online Tax Filing E File Tax Prep H R Block

Trade Services Interior Designer Trade Program Arhaus Arhaus Trading Tax Forms

Bookkeeping Is A Time Consuming Process For Many Entrepreneurs And Business People Spending Time On Bookkeeping Means Tak Finance Saving Finance Bookkeeping

F 1 International Student Tax Return Filing A Full Guide 2022

Dor Keep An Eye Out For Estimated Tax Payments

How To Do Your Taxes In 2022 Cbs News

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Pay Federal Taxes Online With Paypal Payusatax Paypal

Quarterly Tax Calculator Calculate Estimated Taxes

H R Block Review 2022 Pros And Cons

How To Calculate Sales Tax For Your Online Store

Pay Your Taxes Online Louisvilleky Gov

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime